Why Payment Reminders Are Critical for Cash Flow

Cash flow is the lifeblood of every business. Yet, late and outstanding payments remain among companies’ biggest challenges. Studies show that nearly 55% of invoices in the U.S. are paid late, with payments arriving an average of 8 days past the due date. Globally, over 50% of B2B invoices go overdue, and 86% of businesses report that up to 30% of their invoiced sales are consistently delayed. These late payments create unnecessary strain on operations and disrupt predictable revenue streams.

This is where well-crafted payment reminder messages make a difference. By using professional but friendly payment reminder email templates, businesses can gently nudge clients to pay on time—without damaging relationships.

But sending these reminders manually can quickly become tedious and inconsistent. That’s why many companies are adopting automated invoice reminders to ensure timely payments and reduce administrative overhead.

In this article, we’ll cover:

- Why overdue invoices happen

- How to write a polite payment reminder email

- Payment reminder templates you can adapt

- Best practices for sending invoice payment reminders

- The role of automation in scaling reminders

- When to escalate for persistent non-payment

- How upfront payments eliminate the need for reminders altogether

Understanding Overdue Invoices

Before you can write effective payment reminder messages, it’s important to understand why invoices often go unpaid. Contrary to popular belief, most late payments related to unclear payment terms aren’t malicious. Common reasons include:

- Forgetfulness – Clients may simply forget the due date.

- Unclear terms – Vague invoice language or missing details can delay processing.

- Internal delays – Larger organizations may have lengthy approval processes.

- Cash flow struggles – Some clients genuinely face financial issues.

The key is to address overdue invoices with polite but firm reminders. Acting quickly helps ensure prompt payment and recover revenue before small delays snowball into major cash flow issues.

How to Write a Polite Payment Reminder Email

One of the biggest challenges businesses face is how to write reminder email templates that strike the right balance between professionalism and firmness.

Here are some tips to keep in mind:

- Start with a friendly tone – Assume goodwill. Your client may have simply overlooked the invoice.

- Be clear and concise – Mention the invoice number, due date, and amount. Avoid unnecessary details.

- Include a direct payment link – Make it easy for the client to pay in one click.

- Offer assistance – Let them know they can reach out if they’re experiencing issues with the payment process.

- Add a call-to-action – Politely request payment by a specific date.

Example of a Courteous Payment Reminder Email

Subject: Payment Reminder – Invoice #123 is due

Hi [Client Name],

I hope you’re doing well! This is a friendly reminder that Invoice #123 for $1,200 is due on September 1, 2025. You can quickly complete payment using the link below:

[Pay Invoice Now]

If you’ve already made the payment, please disregard this message. If you have any questions or need additional details, don’t hesitate to reach out—I’d be happy to help.

Thank you for your prompt attention!

Best regards,

[Your Name]

Payment Reminder Templates

Creating a library of payment reminder templates saves time and ensures consistency across all client communications. Below are three examples you can adapt to your brand’s tone.

1. Friendly Reminder (Before Due Date)

Subject: Friendly Reminder: Invoice #456 Due Soon

Hi [Client Name],

Just a quick note to remind you that Invoice #456 ($850) is due on October 10, 2025. You can pay securely here:

[Pay Now]

If you’ve already scheduled the payment, thank you! Please ignore this message.

Best,

[Your Name]

2. First Overdue Reminder (1–3 Days Late)

Subject: Payment Reminder – Invoice #789 is Past Due

Hi [Client Name],

I hope all is well. This is a final reminder, and I wanted to follow up on Invoice #789 for $1,450, which was due on August 20, 2025. As of today, the payment is 3 days overdue.

You can complete the payment here:

[Pay Invoice]

If you’ve already sent the payment, please let me know so I can update our records. Otherwise, I’d appreciate it if you could settle the balance by August 25, 2025.

Thanks so much for your prompt attention.

Best regards,

[Your Name]

3. Firm Reminder (Final Attempt Before Escalation)

Subject: Final Notice: Immediate Payment Required – Invoice #1023

Hi [Client Name],

We’ve reached out multiple times regarding Invoice #1023 for $2,300, which is now 30 days overdue.

To avoid service disruption or additional late fees, please complete payment immediately using the link below:

[Make Payment]

If you’re facing challenges with this payment, please reach out today so we can work out a solution. Otherwise, we’ll need to explore alternative actions.

Thank you for your immediate attention.

Sincerely,

[Your Name]

Automating Payment Reminders

Sending manual reminders works when you have a handful of clients. But as your business grows, so does the volume of invoice payment reminders. This is where automation becomes invaluable.

Automation ensures:

- Consistency – Every client receives timely reminders without you having to track due dates.

- Scalability – Manage dozens or hundreds of clients without additional manual effort.

- Efficiency – Free up your team from chasing payments.

- Improved cash flow – Clients are more likely to make timely payments when prompted automatically.

Best Schedule for Automated Reminders

A proven structure is:

- 3–5 days before due date → Friendly reminder

- On the due date → Polite nudge with a payment link

- 1–2 days after due date → First overdue reminder

- Weekly or bi-weekly follow-ups until payment is received

Integrating automated invoice payment reminders with your accounting or booking system helps your business receive payment accurately and minimizes errors.

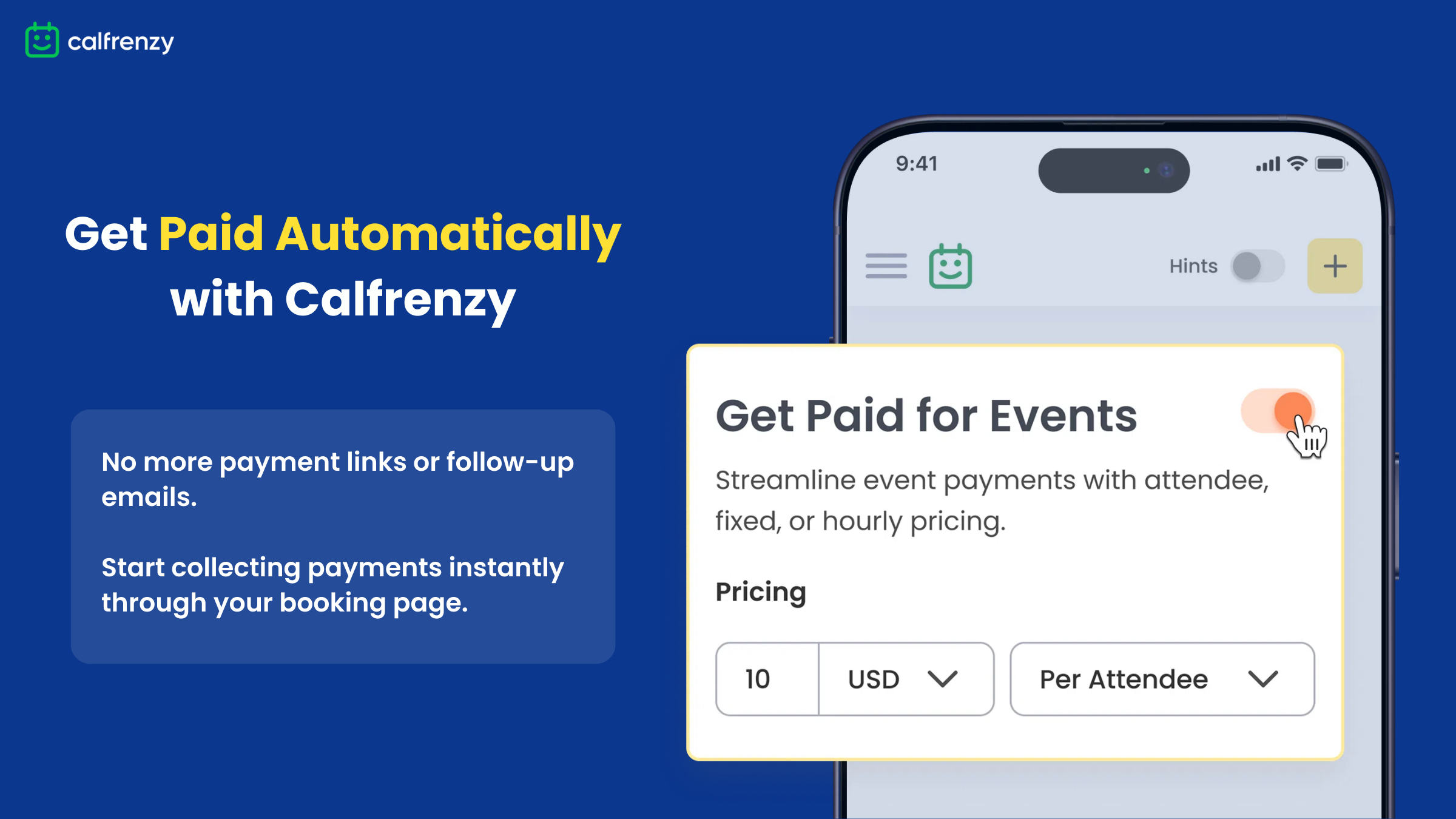

Tired of chasing overdue payments?

With Calfrenzy, you can collect payments upfront at the time of booking using Stripe integration. No more reminders, no more delays.

Best Practices for Payment Reminders

Whether you’re sending manual or automated payment reminder messages, follow these best practices:

- Send reminders 3–5 days before the due date

- Use respectful, professional language

- Include all essential payment details (invoice number, due date, outstanding payment amount)

- Always provide a clear, clickable payment link

- Offer multiple payment options to reduce friction

- Maintain a consistent reminder schedule

- Keep messages short and actionable

- Personalize when possible (reference past payments, thank them for their business)

Dealing with Persistent Non-Payment

Despite your best efforts, some clients may continue to delay or ignore payments. In these cases:

- Stay professional – Avoid emotional or accusatory language.

- Repeat key invoice details – Include invoice number, due date, and outstanding payment balance.

- Be firm about next steps – Mention possible late fees, suspension of services, or legal escalation.

If non-payment continues, you may need to:

- Charge late fees as outlined in your contract

- Suspend access to services until payment is received

- In extreme cases, involve a collections agency or pursue legal action

While escalation isn’t ideal, protecting your business’s financial health is essential.

Maintaining Strong Client Relationships

Chasing outstanding payments doesn’t have to damage your client relationships. In fact, many clients appreciate gentle reminders—it shows you’re organized and professional, which helps maintain customer relationships .

To maintain goodwill:

- Keep messages polite and solution-focused

- Thank clients promptly once payment is received

- Offer flexibility when reasonable (e.g., partial payments or extensions)

- Communicate consistently, not sporadically

Balancing professionalism with empathy ensures you collect payments without burning bridges.

Streamlining the Payment Process

The best payment reminder strategies don’t just focus on reminders—they minimize the need for them. Here’s how to streamline your payment process:

- Request upfront payments – Tools like Calfrenzy make this seamless by collecting payment at booking.

- Offer multiple payment methods – Credit card, ACH, PayPal, and digital wallets.

- Simplify invoices – Use clear formatting with line items, due dates, and direct payment buttons.

- Automate wherever possible – Reduce delays and human error.

By removing friction, and avoiding overdue payment reminders you reduce the chance of outstanding payments and ensure healthier cash flow.

Compare: Traditional Reminders vs. Upfront Payment

| Strategy | Pros | Cons |

|---|---|---|

| Manual Reminders | Personalized, adaptable messaging | Time-consuming, easy to forget |

| Automated Reminders | Scalable, consistent, saves time | Still depends on client follow-up |

| Upfront Payment (Calfrenzy) | Immediate payment, no chasing invoices | Requires client commitment at booking |

Tired of Sending Payment Reminders? Use Calfrenzy Instead

If you’re constantly searching for the best payment reminder templates or wondering how to send a payment reminder without damaging client relationships, there’s a simpler solution: avoid reminders altogether.

Automate Payments at the Source

With Calfrenzy, clients pay at the time of booking. That means:

- No invoices to create or chase

- No need for invoice payment reminders

- No awkward conversations about outstanding payments

Calfrenzy integrates Stripe checkout directly into your booking page, so every appointment is paid for upfront.

Get Paid Automatically

Forget about figuring out how to write a payment reminder email. With Calfrenzy:

- Payments are collected instantly

- Cash flow is predictable

- Your team saves hours on follow-ups

Start Free – Smart Payment Integration for Online Bookings

Frequently Asked Questions (FAQ)

How do I write a polite payment reminder email?

Start with a friendly greeting, mention the invoice number, due date, and outstanding payment amount, and include a direct payment link. Keep the tone professional yet approachable.

When should I send a payment reminder?

Send your first reminder 3–5 days before the due date, another on the due date, and follow up 1–2 days after if unpaid. Continue weekly or bi-weekly until payment is received.

What should a payment reminder email include?

Every reminder should have:

- Invoice number

- Due date

- Amount due

- A clear call-to-action

- A payment link

- An offer to help if needed

How can I automate payment reminders?

Most accounting and booking tools allow you to schedule automatic payment reminder messages. This ensures consistency and saves your team from manually chasing invoices.

How do I avoid sending reminders altogether?

Clients use upfront payment tools like Calfrenzy to pay at the time of booking. This eliminates the need for reminders, reduces outstanding payments, and ensures timely payments.

Final Note

Every business needs a reliable way to get paid. Whether you’re refining your payment reminder strategies with better templates and automation, or moving toward upfront payments with Calfrenzy, the goal remains the same: consistent, timely payments and stronger client relationships, and your attention to this matter is crucial .

Stop losing time chasing overdue invoices. Simplify your process, protect your cash flow, and focus on growing your business.

Sign Up Is Easy 90 Seconds

Ready to make scheduling stress free?

You can register, connect your calendar, and start scheduling in just 90 seconds.

It’s that simple.